Loan Module

About the Loan Module

The Loan Module is used to capture loan information accurately and to assist you with managing loans effectively in your organisation.

The Loan Module allows for the following:

- A configurable risk engine containing the following loan calculators:

- Affordability

- Increase payments, and

- Shorter Loan Term

- Flexible loan management features allowing for

- Repayment holidays, and

- Rate and fee changes.

- Loan Reports

- An Employee Loan statement that can be printed on a monthly basis.

The Loan Module caters for the recording of the following Loans issued by the Company:

- Casual Loans (A low interest/interest free short-term loan),

- Small Personal Loans (Small loan as defined by employer),

- Medium Personal Loans (Medium loan as defined by employer),

- Large Personal Loans (Large loan as defined by employer),

- Study Loans (A loan granted to an employee to further his/her studies),

- Educational Loans (A loan granted to an employee to pay for the education of a dependant),

- Vehicle Loans (A loan granted to an employee to finance the purchase of a motor vehicle),

- Home Loans (A loan granted to an employee for the purchase of primary residence or the purchase of property for investment purposes) and

- General Loans (Other loans).

You are still able to use the regular Loans line.

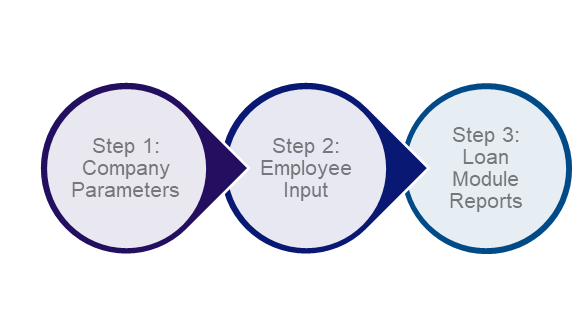

The Loan Module Process

A step-by-step explanation of all aspects necessary for capturing loan information using the Loan Module follows.

|

Step 1: Company Parameters |

||

| 1. Create a Loan Module type deduction line on the Deduction Definition Screen. | ||

| 2. Define Access Control by giving access rights to the operators who will be working with the Loan Module information. | ||

| 3. Access the Loan Control Screen and complete the Company Details Tab as well as the specific loan type tab(s) that will be accommodated. | ||

| 4. Define the Loan Description codes. | ||

| 5. Copy the Loan Module setup to another company | ||

|

Step 2: Employee Input |

||

| 1. Use the Loan Calculator to calculate the maximum loan amount, the repayment amount and/or the effect of an additional payment or shorter loan period on the repayment amount. | ||

| 2. Enter the loan details on the Employee Loan Information Screen. | ||

| 3. Use the Loan Global Activation function to update interest rate changes. | ||

|

Step 3: Loan Module Reports |

||

| 1. Loan Statement Report. | ||

| 2. Loan Report. | ||

| 3. Company Totals. |

Step 1: Company Parameters

Certain company specific parameters need to be defined before input can be done for individual employees, before the loan calculations can be performed and before the necessary Loan Module reports can be printed, namely:

- Creating a deduction line with the Type of Deduction: Loan Module,

- Defining Access Control to allow the responsible operator to enter loan information,

- Entering details on the Loan Control Screen, and

- Ensuring that Loan Descriptions fields have been defined.

A deduction line must be created where the Type of Deduction field is defined as: Loan Module.

Company Lookup Screen > Access Control > Select applicable user

- Loan Control Screen – access to the Loan Control Screen is controlled by the Basic Company Information Screen on Advanced Page 1.

- Employee Loan Information Screen – to set access to the Employee Loan Information Screen, select the correct option (Full, View or No) for the Employee Loan Information field on Advanced Page 3.

Customise Descriptions are found under Company on the Main Menu.

There is a Tab for the Loan Screen. You can customise the Standard Loan Descriptions to a Long and Short Description that suits you.

The Short Description will be used as the Loan Tab Description on the Loan Control Screen.

The Company’s Loan Policy rules, requirements and limitations are recorded on the Loan Control Screen.

Main Menu > Payroll > Loan Module > Loan Control Screen

|

Section |

Description |

|---|---|

| Company Information | The company (lender) name will default from the Basic Company Information Screen. The contact person, contact person telephone number and email address must be completed. |

| Loan Instalment Permitted |

The permitted loan instalment can be calculated as a percentage of the monthly net salary or as a percentage of selected income.

When selecting the Percentage of Monthly Net Salary field, the Allowable Percentage field must be completed. The calculation will be based on the previous month’s nett salary, even in a weekly or bi-weekly company.

When selecting the Percentage of Selected Income field a new window will open where the income components that are to be used in the calculation may be chosen. The Allowable Percentage field must be completed. The calculation will be based on the previous period’s information.

The Allowable Percentage field will default to 25%. The test will be applied against the total of all outstanding loans and not only for individual loan being applied for. |

|

Income and Expenditure Template |

The purpose of this section is to create a printable Income and Expenditure document that is to be completed by the employee as part of the loan application process.

Standard fields have been pre-defined and cannot be modified. The customised field descriptions may be amended to suit specific requirements. |

| Employee Name Format on Correspondence | The format of the employee’s name to be used in any loan correspondence may be defined here. The default is: Title, Initials and Surname. |

| Interest Calculations |

Interest will be calculated from when the loan is approved. The Interest Effective Date field is for information purposes only and will default to the start of the tax year. |

| Commercial Interest Rates |

The following interest rates may be:

These rates and dates will not be used in interest calculations and is only for information purposes. |

| Approved Loan Types |

The type of loans that will be granted by the company to an employee may be defined in this section. This will determine the options that are available on the Employee Loan Screen. The available options are:

|

|

Loan Period Affected By |

The retirement age of the employee must be taken into account when determining the affordability of the loan and the number of instalments to repay the loan. The retirement age will default to 65, but may be modified to align with company policy. |

|

Copy Loan Setup |

The Copy Loan Setup button allows for the Loan Control Setup to be copied to other companies. |

The individual Loan Type Screens must be configured in accordance to the company’s policy regarding the issuing and management of loans.

The Loan Module caters for six different types of loans.

|

Section |

Description |

|---|---|

| Interest Rates | The Minimum, Standard and Maximum interest rates applicable to the loan type must be defined. Interest rates can range from 0% to 75%. |

| Other Guidelines | This section allows for the definition of the Minimum Loan amount, the Maximum Loan amount, the Maximum Loan Period and the Minimum Service Period applicable to the type of loan. |

| Fees |

There are two types of fees, i.e. an Initiation Fee and an Administration Fee. These fees can be configured to be calculated as follows:

|

| Loan Insurance | This field is available for Personal Loans, Study Loans, Educational Loans, Vehicle Finance and Home Loans. |

The documents that need to be completed for each loan application process may be defined on the Documents Screen. Provision has been made for 10 documents in addition to the 10 standard documents that have been pre-defined.

Main Menu > Payroll > Loan Module. > Loan Description Codes

Descriptions may be added for the following fields:

- Loan Reason,

- Approved By, and

- Suspension Reason.

Main Menu > Payroll > Loan Module. > Loan Control Screen > Copy Loan Setup button

The Loan Control Screen structure may be copied from a company to another company or to an interface file.

Step 2: Employee Input

After the company parameters have been defined, you are ready to proceed with input on employee level.

Employee input can be categorised into the following areas, namely:

- Making use of the Loan Calculator to calculate the maximum loan amount that an employee qualifies for, the instalment amount, the effect that an extra payment or shorter loan period will have on the interest and instalment amount.

- Entering the loan information on the Employee’s Loan Agreement Screen.

- Global Activation of a change in the interest rate.

Main Menu > Payroll > Loan Module > Employee Loan Information > Select employee > Employee Loan Summary Screen > Loan Calculator button in the top left hand corner of the screen.

There are four Loan Calculators available in the Loan Module:

- Maximum Loan amount,

- Instalment amount,

- Extra payments, and

- Shorter Loan Period.

NOTE:

The Routing code 'LN' may also be used to access the Employee Loan Summary Screen from any of the employee’s screens.

The Loan Amount Calculator calculates the maximum loan that an employee qualifies for based on the employee’s income and expenditure, interest rate and loan term. The rules defined on the Loan Control Screen with regards to the maximum percentage of the loan vs. the employee’s income, the minimum and maximum interest rates and fees will be adhered to.

The following fields must be completed:

- Type of Loan – select an option from the dropdown box

- Interest Rate % – the field will default to the standard interest rate as defined on the Loan Control Screen.

- Loan Term – the field will default to the maximum loan term as defined on the Loan Control Screen.

- Net Monthly Income – the previous period’s nett salary of the employee will display in this field.

- Monthly Expenses – according to the Income and Expenditure statement as completed by the employee.

The employee’s loan instalment will be calculated based on the loan amount, interest rate and the loan term.

The following fields must be completed:

- Loan Amount,

- Interest Rate, and

- Loan Term.

The Extra Payment Calculator calculates the interest saved as a result of an extra payment made by the employee.

The following fields must be completed:

- Loan Amount,

- Interest Rate,

- Loan Term, and

- Additional Payment amount.

The Shorter Loan Period Calculator works out the interest saved by repaying the loan over a shorter period than the original loan term.

The following fields must be completed:

- Loan Amount,

- Interest Rate,

- Loan Term, an d

- Shorter Term.

NOTE:

To display the result of the requested calculation, click on the Calculator button.

The calculation result can be printed by clicking on the Print button in the top left-hand corner of the screen.

Main Menu > Payroll > Loan Module > Employee Loan Information > Select the relevant employee

or

Employee Payslip Screen > Deductions Tab > Double-click in the Amount column of the Loan Module deduction line to open the Employee Loan Summary Screen.

This screen will provide a summary of all the loans that are active for an employee on the Current Loans Tab as well as a history of all the loans that are no longer current for the employee on the History Loans Tab.

The Current Loans Tab displays a summary of any active loans and allows you to add, edit or delete loan information.

Loans with the following statuses will show on the Loan History Tab:

- Handed Over,

- Paid Up, and

- Transferred.

To open the Loan Agreement Screen, click on the Add button on the Current Loans Tab. The Loan Agreement Screen will be displayed:

Fields on the Loan Agreement Screen:

|

Field |

Description |

|

Type of Loan |

Select the Type of Loan from the drop-down menu. The available Loan Types will be displayed as per the selections made on the Loan Control Screen.

The full list of available loan types are:

This is a mandatory field. |

|

Reference Number |

Enter the unique reference number. This is a mandatory field. |

|

Loan Amount |

The loan amount entered cannot be greater than the maximum or smaller than the minimum loan defined for the specific loan on the Loan Control Screen. This is a mandatory field. |

|

Interest Rate |

The interest rate for this specific loan will default from the Loan Control Screen. This is a mandatory field. |

|

Loan Period in Months |

This is a mandatory field. In a Weekly, Bi-weekly or Other Period company the number of remaining periods (Weeks, Bi-weeks or Other) will be displayed next to the Loan Period in Months field. This information will only display after the Start of Period into the second loan period. The remaining periods will decrease with every Start of Period except in the case of Suspended and Frozen loans. |

|

Loan Status |

The available Loan Statuses are:

NOTE: The loan process can be started by selecting either the Applied or Approved Loan Status. |

|

Loan Reason |

The loan reason can be selected from the lookup list or can be added at this point. |

|

Start Date |

Select the date from the Calendar drop-down box or enter the date in the correct format. |

|

Rate Effective |

Select the date from the Calendar drop-down box or enter the date in the correct format. Interest will be calculated pro-rata according to this date. |

|

Approved By |

Select the approver from the lookup list or add an approver at this point. |

|

Taxable Perk |

The module will not calculate the taxable fringe benefit. This will be included in a future enhancement of this module. |

|

Interest Rate Fixed |

If the tick has been turned on, the employee will not be affected when the interest rate is changed globally. |

|

Retain Higher Payment |

If the tick has been turned on, the employee will not be affected if any of the factors in the instalment calculation, for example: interest rate or loan term, results in a lower instalment than the current value. |

|

Period Amounts |

These amounts are calculated by the system and are for information purposes only. The only field that can be modified is the Adjustment field. |

|

This amount will be equal to the closing balance of the previous period. |

|

The instalment amount is calculated by the system and is split into a capital and an interest portion. |

|

Total of the Administration Fee and/or the Initiation Fee if applicable. |

|

Any amount you have entered to increase or reduce the loan instalment amount. A number of times must be specified. |

|

This is the amount that will display on the Payslip Screen as a deduction for the current period. |

|

The Balance C/F = Opening Balance plus Interest + Fees – Payment. |

|

Documents |

The purpose the Documents Screen is to keep track of the supporting documentation required to complete the loan application process. The list of document required for each type of loan will default from the selection done on the Documents Tab of the Loan Control Screen.

The Loan Status of a loan application cannot be successfully changed to Approve until the Received column of all the required documents have been flagged as Yes. The system will generate the following message when you attempt to change the Loan Status to Approve before flagging all the documents specific to this type of loan as Received. |

NOTE:

The entered information on the Loan Agreement Screen will only be conserved if you click on the Save button before exiting the screen.

To edit the Loan Agreement, click on the Edit button of the Loan Summary Screen.

The following fields may be changed on the Loan Agreement Screen:

- Interest Rate – the interest rate may be increased or decreased.

- Rate Effective – enter the date that the new interest rate must be effective from.

- Loan Status – select a Loan Status from the drop down list.

- Adjustment – An adjustment may be made to the instalment amount and the number of times that the adjustment must be executed may be specified.

To delete a loan, click on the specific transaction to highlight it and click on the Delete button. If the loan may be deleted (see below), the Loan Agreement Screen will be displayed. If the loan may not be deleted (see below), the following message will be displayed:

Only loans with the following statuses may be deleted:

- Applied,

- Approved, or

- Active – only in the first loan period.

The following message will appear to verify the deletion of the record:

Click on Yes to delete the loan. The loan transaction will be completely removed from the employee’s record.

The List button allows you to view a statement of transactions with Debit, Credit and Balance columns will be shown for the selected filter. The available filter options are: Type of Loan, Loan Status and Transaction Period.

NOTE:

The transactions can be printed by clicking on the Print button in the top-left hand corner of the Leave Transaction Summary Screen.

How to make a Balance Adjustment

The Balance Adjustment function allows you to make amendments the outstanding balance with the purpose to recalculate the repayment value of the loan. The following transactions are available:

- Payment Received (Cr),

- Reverse Interest (Cr),

- Reverse Charges (Cr),

- Additional Interest (Dr),

- Additional Charges (Dr), and

- Reverse Payment (Dr).

Once the transaction has been selected, enter the amount of the adjustment and click on the Write Transaction button to save the adjustment.

The Balance C/F value on the Loan Summary Screen will be adjusted and the loan repayment amount will be recalculated.

The Global Activation function will allow you to globally increase or decrease the interest rate value for a selected group of employees and/or for selected types of loans.

Main Menu > Payroll > Loan Module > Loan Global Activation

Take note of the warning message and click on the Continue button to advance to the next screen.

NOTE:

Only the Types of Loans defined on the Loan Control Screen will be displayed in the drop-down menu.

Change, Increase or Decrease the Interest Rate

Only one of the options will be available at any given time. If you selected to change the Interest Rate, then the Increase the Interest Rate and Decrease the Interest Rate options will be unavailable and vice versa.

- Change the Interest Rate for Employees to: This option will overwrite the Interest Rate for the selected employees and the Rate Effective on the Employee Loan Agreement will change to 1st day of the current pay period. The Interest Rate Value, Capital Amount, Instalment and Closing Balance will be recalculated.

- Increase Interest Rate for Employees with: The Interest Rate for the selected employees will be increased with the value entered and the Rate Effective on the Employee Loan Agreement will change to the 1st day of the current pay period. The Interest Rate Value, Capital Amount, Instalment and Closing Balance will be recalculated.

- Decrease Interest Rate for Employees with: The Interest Rate for the selected employees will be decreased with the value loaded and the Rate Effective on the Employee Loan Agreement will change to the 1st day of the current pay period. The Interest Rate Value, Capital Amount, Instalment and Closing Balance will be recalculated.

Apply these changes for:

- All Employees,

- Category,

- Paypoint,

- Department, and

- Job Grade.

NOTE:

The above selections will only apply to active employees and current terminations (if so selected) with Approved, Active or Suspended Loans. Loans with the status Applied, Frozen or Handed Over will not be affected.

Click on the Continue button to activate the amendment for the current pay period.

Step 3 – Loan Module Reports

After the company parameters have been defined and all employee input has been completed, you can print the necessary Loan Module reports.

These reports contain loan reconciliation information and opens up in a preview screen, allowing you to select the pages you want to print.

Main Menu > Payroll > Loan Module > Reports

The following reports are Standard Loan Reports:

- Loan Statement Report,

- Loan Report and

- Company Totals